On January 1, 2024, a new law in the United States called the Corporate Transparency Act (CTA) will go into effect. It is made to address the issue of untraceable shell corporations being utilized for dubious activities like tax evasion and money laundering. Proper reporting of foreign income and domestic activities is mandatory for cross-border companies with income earned in both countries. To stay in “compliance,” a trusted advisor such as a CPA or Tax Attorney should be consulted.

Companies doing business in the United States, whether domestic or international, will be compelled to reveal who their real owners are under the CTA. They must thus disclose information about their businesses, including their names and addresses, as well as information about the people who own or control them. This applies to owners who hold dual citizenship, NRIs, (Non-Resident Indians), & others.

The CTA’s principal objective is to promote transparency and stop these covert businesses from aiding in illicit financial activity. The Financial Crimes Enforcement Network (FinCEN), which is a division of the Department of the Treasury, will be responsible for enforcing it.

There are a few exceptions, though. For instance, these new reporting requirements won’t apply to firms registered with the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC), public companies, banks, credit unions, and insurance companies.

In a nutshell, the CTA is an effort to increase the transparency of corporate ownership in the United States, making it more difficult for unlawful operations to go unnoticed by using fictitious shell corporations as a front.

Please don’t hesitate to contact us if you have any more questions about International Tax Compliance. We’re available to provide you with a complimentary consultation and address your concerns.

Abbreviated Steps for Compliance:

1) See if any existing entity requires a separate TIN

2) Draw out an Organizational Chart of Beneficial Ownership

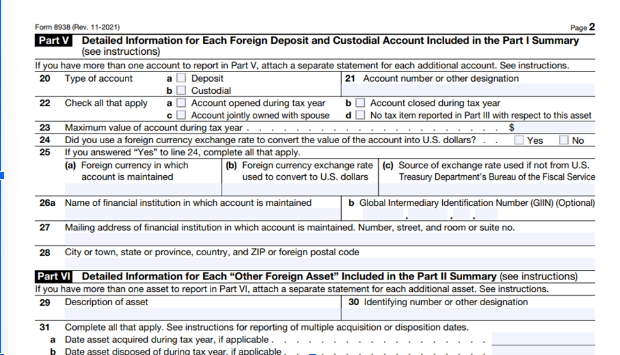

3) Talk-Thru Form 8938 Statement of Specified Foreign Financial Assets w/your CPA/Tax Advisor.

This form will make you list the location (India, Sri Lanka, etc); The Number of Deposit Accounts, the $ value, & Local Currency Value of Bank/Brokerage Accounts (Rs, Pesos, etc)

Source: https://pages.pagesuite.com/9/e/9e3968fa-26ff-4f8e-afcf-375d4a8bb7e0/page.pdf

Take a look at this: Discover the Best Over-the-Counter ED Remedies